GET CARE WHEREVER YOU GO To help you and your family get the best possible health care coverage at the most affordable price, we’ve created a presentation to better prepare you for the upcoming year. If you need help with your research or want to learn from an insurance expert, contact the ‘A’ Team for more info.Presentation on theme: "Going beyond your health plan coverage"- Presentation transcript: These plans aren’t for everyone, but you should definitely consider them as you search for different ways to battle the continued increasing costs in healthcare.

Businesses with small margins that can’t absorb the fluctuating medical costs from year to year as well as businesses with a visionary leadership team that want to apply a reasonable and fair approach to the cost of their medical plan can all benefit from a RBP plan. The growth we see in RBP is in industries that have been cost shifting to employees and need a better solution. Reality: It requires excellent employee communications as it’s not what employees are accustomed to. Reality: It requires self-funding with a Third Party Administrator (TPA).

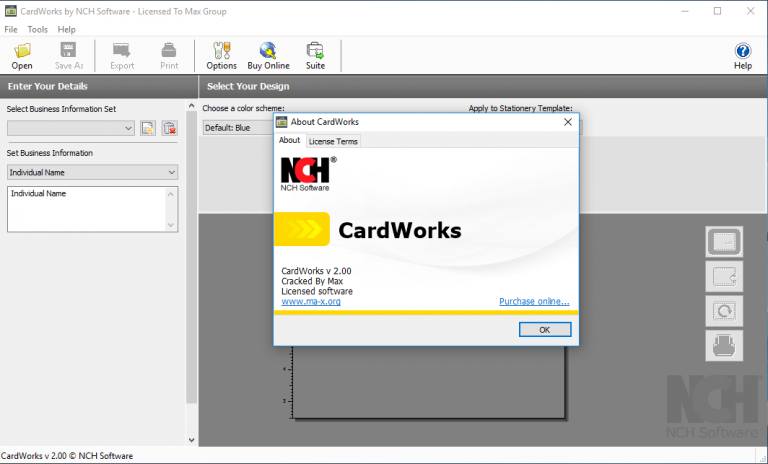

#CARDWORKS NETWORK BY AETNA FULL#

Reality: It requires full understanding and support by Senior Management. Reality: The BUCA plans (BCBS, UHC, Cigna, Aetna) do not offer RBP models. Reality: RBP Models are a newer concept they have entered the marketplace in the past 10 years. So why have you not heard more about this? There are several different Reference Based Pricing Models in the marketplace that can save you 25 to 30% on your claim costs. In Illinois, the average hospital markup over Medicare is 345%! Imagine if your company had access to those margins! By starting from the Medicare reimbursements and adding on a fair and reasonable margin, the plan eliminates the inflated billing practices and brings it back to a transparent rate based on a known cost basis. RBP allows you to go to your hospital of choice and reimbursements to the hospitals are based on published Medicare rates. The current network-driven marketplace is one of the reasons healthcare costs continue to rise well above the cost of inflation, and fair and reasonable charges are not defined or are even able to be identified. This way, the hospital receives a fair and reasonable reimbursement, and both the plan and patient pay fair and reasonable charges. RBP takes a bottom up approach: they start with the costs of hospital medical services that are self-reported to CMS, and then add a fair and reasonable margin. Just look at the ridiculous costs of the billed expenses on your Explanation of Benefits statement prior to the discount being applied. You may think: the bigger the discount the bigger the savings however, many times it simply means the billed charges are inflated to increase the savings percentage. That’s a top down approach with no transparency on how it actually relates to the cost of the service.

PPO plans start with an inflated charge and then discount it to show client savings by using that network. Reference Based Pricing works differently than a traditional medical plan with a PPO network. Reality: Healthcare costs are one of the top 3 expenses on a company’s P&L statement.

Reality: Your PPO plan’s ID card works like an unlimited and unchecked expense account. Reality: Billed hospital charges are not based on actual costs to provide services. It means Reference Based Pricing, but I like to refer to it as “Reality Based Pricing.” Here’s why: What does the acronym RBP mean in the insurance industry? Want to learn more about Reference Based Pricing Models? Watch our RBP webinar replay!

0 kommentar(er)

0 kommentar(er)